2024 Guide to Reverse Mortgage Purchase (HECM Purchase)

|

Michael G. Branson, CEO of All Reverse Mortgage, Inc., and moderator of ARLO™, has 45 years of experience in the mortgage banking industry. He has devoted the past 19 years to reverse mortgages exclusively. (License: NMLS# 14040) |

|

All Reverse Mortgage's editing process includes rigorous fact-checking led by industry experts to ensure all content is accurate and current. This article has been reviewed, edited, and fact-checked by Cliff Auerswald, President and co-creator of ARLO™. (License: NMLS# 14041) |

Reverse mortgages are a popular option for people who want to stay in their homes as they get older. But did you know there’s a special kind of reverse mortgage that lets you buy a new home without needing to pay all cash or get a regular mortgage? It’s called a Reverse Mortgage Purchase.

Choosing a Reverse Mortgage Purchase can be very helpful in many situations:

- You want to downsize to a smaller, easier-to-manage home.

- You prefer a single-level home that is more suitable for aging comfortably.

- You need to move closer to your family for support and assistance.

With a Reverse Mortgage for Purchase, through a program called the Home Equity Conversion Mortgage (HECM) for Purchase, you can make the process easier. This program lets you get a reverse mortgage and buy a new home in one smooth step.

Reverse Mortgage Purchases Basics

The HECM for Purchase is the most common reverse mortgage used to buy new homes. Applying for and qualifying for a HECM for Purchase follows the same steps as applying for any HECM loan.

Here are the main requirements:

- Borrowers must be 62 or older and meet the financial guidelines set by HUD.

- Borrowers need to make a significant down payment. The reverse mortgage will cover the rest, requiring no monthly mortgage payments.

After getting a HECM for Purchase, borrowers must:

- Keep the home in good condition to meet FHA standards.

- Pay property taxes and homeowners’ insurance on time.

- Pay any other property charges, like HOA dues.

The main difference between using a reverse mortgage to purchase a home and getting a reverse mortgage later is that the purchase is all done in one transaction, which means there are no duplicate fees.

For a Reverse Mortgage Purchase, the borrower needs to cover the down payment for the new home, which includes the required mortgage insurance. This may cost more than a typical conventional home mortgage but is still less expensive than buying a home and then getting a reverse mortgage later.

If you’re considering a reverse mortgage, a single Reverse Mortgage Purchase is often a better option than buying a home and refinancing with a reverse mortgage later.

Eligible Properties

- Single-family homes

- Planned Unit Developments (PUDs)

- 2–4-unit dwellings

- HUD-approved condominiums

A certificate of occupancy must be in place for new construction before completing a HECM for purchase transaction. Most property types can be purchased with a reverse mortgage, with a few exceptions.

Ineligible Properties

- Homes under construction and not yet habitable

- Co-ops, boarding houses, and bed-and-breakfasts

- Newly constructed homes without a Certificate of Occupancy

Certain types of manufactured homes may also be ineligible for reverse mortgage financing, especially those built before 1976. HUD sets minimum standards for manufactured homes, and any properties that do not meet these standards are not eligible for a reverse purchase mortgage.

Estimating Your Down Payment

The reverse mortgage for purchase program requires the borrower to cover the down payment on the new home purchase. The down payment requirement for a purchase with a reverse mortgage is higher than most other types of financing, but then borrowers have no required monthly payments.

In many cases, borrowers use the equity from the sale of their existing house for the down payment on the new home. In other cases, the borrower may need to cover the down payment through savings or other means.

If the value of the old home is less than the down payment required for the new home, the borrower will need to provide the difference in cash. Some gifts and other sources may also be allowed under FHA requirements, such as family gifts from those who do not have a stake in the transaction.

If you need to use gift funds, you should always discuss with your lender so that you can verify the requirements for gift fund verification and eligibility in advance.

The down payment requirement is based on the following:

- The age of the youngest borrower

- Current interest rates

- The price of the new home, or the HECM lending limit of $1,149,825

Typically, the down payment for a HECM for Purchase is 45-70% of the purchase price. The following table provides examples of down payment requirements for various home prices and borrower ages.

With a reverse mortgage for purchase, the borrower must cover the down payment for the new home. While this down payment is higher than for most other types of financing, there are no required monthly payments afterward.

Many borrowers use the equity from selling their current home to make the down payment on the new home. If this isn’t enough, the borrower may need to use savings or other sources. If the sale of the old home doesn’t cover the down payment for the new home, the borrower will need to provide the difference in cash.

FHA allows some sources, such as family gifts from those who do not have a stake in the transaction, to help with the down payment. If you plan to use gift funds, discuss this with your lender to ensure you meet the requirements for gift fund verification and eligibility.

The down payment requirement depends on:

- The age of the youngest borrower

- Current interest rates

- The price of the new home, or the HECM lending limit of $1,149,825

Typically, the down payment for a HECM for Purchase is between 45-70% of the purchase price. The table below provides examples of down payment requirements for various home prices and borrower ages.

HECM Purchase Down Payment Estimates by Age and Home Value

Please note that this is not a lending offer. The down payment figures provided are estimates, inclusive of the majority of essential closing costs, such as a 2% upfront mortgage insurance fee and third-party closing costs. These estimates are based on an interest rate of 6.93%, which includes an expected rate of 6.10% and an adjustable CMT margin of 1.625%, accurate as of December 4, 2023.

Age % Down $200,000 $400,000 $600,000 $800,000 $1,00,0000

62 67.2% $134,400 $268,800 $403,200 $537,600 $672,000

65 65.1% $130,200 $260,400 $390,600 $520,800 $651,000

70 61.4% $122,800 $245,600 $368,400 $491,200 $614,000

75 58.5% $117,000 $234,000 $351,000 $468,000 $585,000

80 54.1% $108,200 $216,400 $324,600 $432,800 $541,000

85 47.9% $95,800 $163,600 $287,400 $383,200 $479,900

90 40.9% $81,800 $163,600 $245,400 $327,200 $400,900

Sourcing Your Down Payment

Here are common sources for your down payment:

- Cash on hand (savings, 401k, etc.)

- Proceeds from selling your home

- Gifts from family

The most common ways to meet the down payment requirement are proceeds from the sale of your previous home and savings. The Federal Housing Administration (FHA), which insures the loan, accepts various funding sources.

Acceptable sources for financing the down payment include:

- Earnest money deposits

- Withdrawals from savings accounts, checking accounts, or retirement funds

- Gift money from family members, employers, charities, government organizations focused on homeownership, or close friends with a documented interest in the borrower

All funds must be verified. Gifts from anyone involved in the transaction are not acceptable. Other less common funding sources, such as collateralized loans, savings bonds, and employer assistance programs, can also be used.

Down Payment Sources You Can’t Use

The following sources are not acceptable for your down payment:

- Sweat equity

- Trade equity

- Rent credit

- Cash from anyone benefiting from the reverse mortgage transaction

- Cash advances from credit cards

Today's Reverse Mortgage Purchase Rates

Example calculation using fixed rate:

2024 Lending Limit Fixed Rate Adjustable Rate

$1,149,825 7.180% (8.700% APR) 6.885% (2.125 Margin)

$4,000,000 10.125% (10.612% APR) 11.385% (6.625 Margin)

7.18% + .50% Monthly MIP = 7.68% in total interest charges. Fixed Rate APR calculated assumes a $250,000 loan amount and includes .50% Mortgage Insurance and standard 3rd party closing costs.

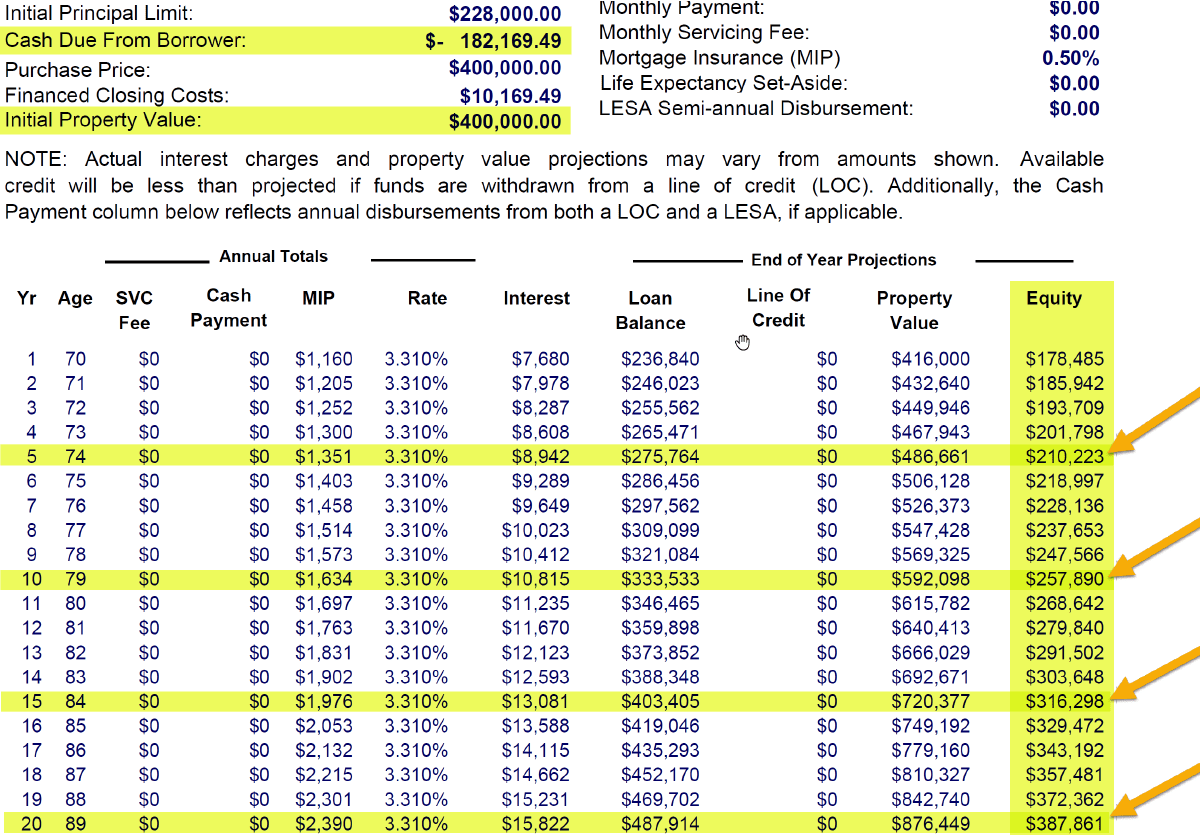

Example of Reverse Mortgage Purchase

Let’s look at an example using a 70-year-old borrower who uses a reverse mortgage to buy a $400,000 home. The required down payment is $182,000, which is approximately 45% of the purchase price.

Predicting future interest rates or how much your home will appreciate over time is difficult. For this example, we’ll use a 4% annual appreciation rate for the home. The interest is calculated using an “expected rate” based on a 10-year index rather than the lower initial index rate.

While many properties appreciate more than 4% annually, 4% is a conservative estimate. You can adjust this based on your own expectations for your home’s appreciation.

The down payment covers all upfront mortgage insurance premiums and third-party closing costs. Based on the assumptions mentioned, the borrower would have $210,000 in home equity after five years of making no mortgage payments. After ten years, this amount would increase to $257,000.

If the borrower later decides to move into an assisted care facility, the loan becomes due. The borrower or their family can sell the home. Any equity above the outstanding loan balance belongs to the borrower and their heirs. They can:

- Pay off the loan and keep the house

- Sell the home and keep the proceeds

- Walk away and owe nothing

The remaining equity depends on the home’s future appreciation, interest rates, the amount and timeliness of reverse mortgage funds drawn (which are 100% at inception for a purchase), and whether the borrower makes any early voluntary repayments.

Also See: Here’s an Ideal Reverse Mortgage Purchase Example

Advantages and Disadvantages of Reverse Mortgage Purchases

The HECM purchase program can be an excellent option for those who want to move during retirement, as it allows them to do so without making monthly mortgage payments. However, like all loans, there are some pros and cons.

Additional Considerations

When purchasing a home with a reverse mortgage, it’s important to consider the real estate agent’s experience with reverse mortgages. While your mortgage originator can assist with questions, working with a real estate agent familiar with reverse mortgage transactions can be beneficial.

2024 Purchase Changes & Improvements

- Assistance with Borrower’s Fees: Parties involved in the home-buying process, such as sellers, agents, and builders, can now contribute up to 6% of the home’s cost to help with various fees.

- Uses of the 6% Contribution: This amount can cover expenses like origination fees, closing costs (including credit reports and appraisals), prepaid items, discount points, interest rate reductions, and the initial mortgage insurance premium. However, it cannot be used for counseling fees.

- Additional Funding Options: In addition to the HECM loan, you can use other sources, such as gifts, disaster relief grants, and employer assistance, to fund your share of the purchase.

- Seller-Related Fees: Usual seller fees, such as real estate commissions and home warranty costs, are permitted and do not count towards the 6% limit.

- PACE Liens: Clearing a Property Assessed Clean Energy (PACE) lien by the seller is not considered an interested party contribution under this program.

These updates make buying a home easier under the HECM for Purchase program by allowing more financial support from various sources.

For More Information:

- Check the FHA Single Family Housing Policy Handbook at Hud.gov.

- Refer to the Federal Register for detailed updates.

Purchase FAQs

Can you get a reverse mortgage on a purchase?

Yes. Reverse mortgages have been available for purchase transactions since 2008. The FHA implemented this to eliminate the need for borrowers to do two separate transactions when buying a new home.

How does a reverse mortgage purchase work?

A reverse mortgage for purchase works similarly to a standard reverse mortgage. The loan amount is calculated using the age of the youngest borrower/spouse and the interest rate. The borrower then brings in funds at closing to cover the difference.

How much is the down payment required on a reverse mortgage purchase?

The down payment required depends on the borrower’s eligibility as determined by the HECM purchase calculator. Factors include the age of the youngest borrower/spouse, the interest rate, and the HUD lending limit. Typically, a 62-year-old borrower may need a down payment of about 36% of the purchase price, while a 92-year-old may need about 65%.

Can I use funds from a cash-out refinance for the down payment on a HECM purchase?

No, HUD does not allow the use of borrowed funds for the down payment on a HECM purchase. The funds must be in your account and seasoned.

How can I use a life insurance policy to get the cash necessary for the down payment on HECM for purchase?

If you sell the policy or withdraw funds available, show the terms of the sale or withdrawal and the receipt of funds through the deposit in your account. You cannot borrow against the policy for the down payment.

Should the reverse mortgage purchase appraisal be near the asking price or just over the loan amount?

Are condos eligible for the purchase reverse mortgage?

Yes, but the condominium project must be HUD-approved. There are also jumbo or proprietary programs for non-FHA-approved condos, but the HUD program is recommended for higher loan amounts and lower interest rates.

Can I purchase a multifamily property with a reverse mortgage and live in one of the units?

Yes, HUD allows up to four units in the reverse mortgage program if the property is owner-occupied.

Can you use a reverse mortgage purchase loan and then move to a nursing home?

To be eligible, you must occupy the property as your primary residence. If you move into an assisted living facility, the home will no longer qualify as your primary residence.

Can I purchase with a reverse mortgage if I had a bankruptcy three years ago?

HUD is stricter on credit for the purchase program. If your credit issues were three years ago and your credit has been good since you might qualify with a strong letter of explanation. A lender must review your credit history first.

Can my spouse use a reverse mortgage to purchase the home as the sole owner?

If your state permits a non-borrowing spouse arrangement for reverse mortgages, your spouse could be recognized as such from the start of the process. However, you must meet specific conditions, including attending mandatory counseling sessions and signing documents.

Can you sell the house, and if so, are there time constraints or limitations?

Can you sell the house, and if so, are there time constraints or limitations?

Is it possible to sell a home with an existing reverse mortgage and use the proceeds to buy a new one with a new reverse mortgage, allowing both transactions to close simultaneously?

Yes, but the new home can only close once the new reverse mortgage lender has verified that the old loan is fully paid off. There may be a slight delay between the transactions.

How can I find realtors who understand HECM for purchase?

Look for real estate professionals with experience in reverse mortgage transactions. Call a few real estate firms and ask if they have agents familiar with the program. Understanding HUD rules and requirements is crucial.

ARLO recommends these helpful resources:

- Read about our own HECM Purchase client success story in Kiplinger’s Retirement Report

HECM Purchase YouTube Series

Have a Question About Reverse Mortgages?

Michael G. Branson

Michael G. Branson Cliff Auerswald

Cliff Auerswald

March 17th, 2024

March 19th, 2024

August 10th, 2021

August 10th, 2021

November 24th, 2020

November 24th, 2020

May 26th, 2020

May 26th, 2020

January 14th, 2013

January 15th, 2013

November 26th, 2012

December 4th, 2012